For example, if you have credit card debt at 15 percent, it makes more sense to pay it off before putting any extra money toward your mortgage that has only a 5 percent interest rate.įurther, unlike many other debts, mortgage debt can be deducted from income taxes for those who itemize their taxes.Īlso consider what other investments you can make with the money that might give you a higher return. Though it can help many people save thousands of dollars, it's not always the best way for most people to improve their finances.Ĭompare your potential savings to your other debts.

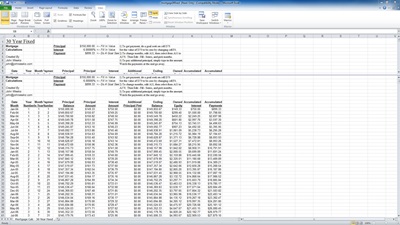

Paying off your mortgage early isn't always a no-brainer. Even paying $20 or $50 extra each month can help you to pay down your mortgage faster. However, you don't have to pay that much to make an impact. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest. Over the course of the year, you will have paid the additional month. Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. There are 26 bi-weekly periods in the year, but making only two payments a month would result in 24 payments. Payments are made every two weeks, not just twice a month, which results in an extra mortgage payment each year. One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.Įarly Loan Repayment: A Little Goes a Long Way After all, what's the point? Unless you're doubling up on your payments every month, you aren't going to make a significant impact on your bottom line - right? You'll still be paying off your loan for decades - right? You might not even think about trying to pay off your mortgage early. When you sign on for a 30-year mortgage, you know you're in it for the long haul. Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.įor your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement.

0 kommentar(er)

0 kommentar(er)